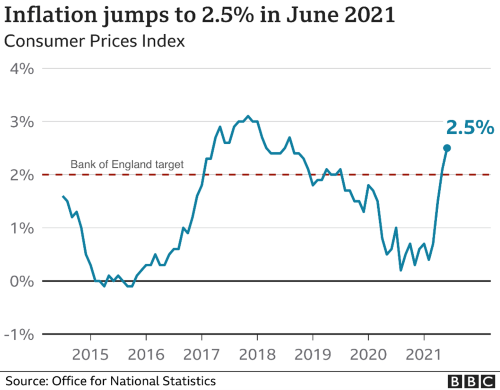

The inflation rate in the UK is currently at 2.5% and the inflation rate for the US has risen to 5.4% (June 2021). Due to the loosening of social restrictions and economies opening up after a very difficult period, we are seeing inflation rates higher than they have been for several years. Whilst you should not be immediately alarmed or concerned about this, it is important to understand what this means and how it could impact you.

What is inflation?

Inflation is the general increase in prices in the economy. Inflation occurs when there is an increase in prices across many different goods and services, not just for a particular type of good. A convenient way of thinking about this is to imagine a very large “shopping basket” containing those goods and services bought by households. This basket includes basic expenses like food, clothing, furniture, household goods, transport costs and entertainment. As the prices of the various items in the basket change over time, so does the total cost of the basket. Movements in the inflation rate represent the changing cost of the shopping basket. For example, inflation in the UK is currently at 2.5% as measured in June 2021. This means that the overall price of the shopping basket has risen by 2.5% over the past twelve months.

Why is inflation rising?

Inflation can occur for different reasons, but usually it is driven by people spending more as the demand for goods and services increases which outstrips supply, causing prices to increase. With the country opening up after lockdown and businesses return to normal, spending will increase as the economy recovers from the recession caused by coronavirus restrictions and will therefore lead to higher inflation. The Bank of England expects inflation to exceed 3% in the coming months, but it has said the increase in inflation is likely to be temporary. Most economists currently expect spending and inflation to return to stable levels after an initial high period of demand as lockdown restrictions are eased, but this picture may change over the next few months.

The Bank of England is responsible for keeping inflation at 2%. It does this by setting the Bank Rate which influences all the interest rates in the economy such as the interest rate for savings accounts and loans. Currently the Bank Rate is at 0.1%, which is the lowest it has ever been. If inflation persistently remains above 2%, the Bank of England will increase interest rates to bring inflation back down to target.

Should I be worried?

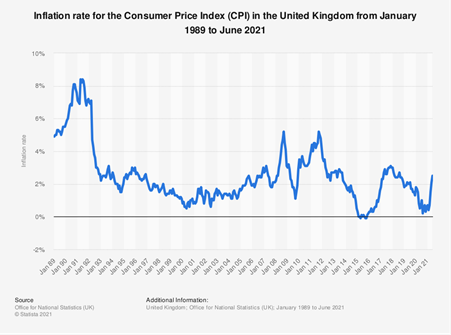

No, inflation in the UK is still at relatively small levels and the recent rise is expected to be temporary. A small level of inflation is natural and needed in a healthy economy, since a consistent fall in prices (deflation) can have very negative consequences. Inflation only becomes a serious problem if it rises to much higher levels and spirals out of control. This is unlikely to happen in a developed economy like the UK, where we have a strong currency and independent central bank whose job is to ensure inflation stays low. The central bank’s confidence that they have things under control is largely shared by market professionals.

However, those investors who believe the risk of rising inflation is high, would argue that the era of ultra-low interest rates may be over, in which case fixed-interest bonds will prove toxic, and bond prices will fall inflicting heavy capital losses. Other investors in equities and properties, and business owners with similar cautious mindset would be concerned about a rise in bank rate, impacting negatively on corporate profits and property values.

The chart below shows historical trend since January 1989:

How could it impact me?

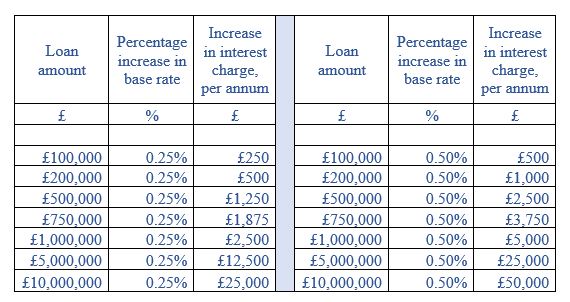

In the short-term you may notice a rise in prices for some products, however you should not notice a significant increase in your cost of living. Where you are more likely to feel an impact is when the Bank of England decides to raise interest rates. This is unlikely to happen in the next few months unless inflation rises much higher, however interest rates could rise next year if the economy continues to recover strongly from the coronavirus. This would mean that the interest rate in your savings account would increase but so would the rates on new loans and mortgages or existing loans without fixed interest rates, such as a variable-rate mortgage. If you are considering taking out a loan or mortgage in the near future, it would be prudent to watch how the inflation rate changes and if the Bank of England gives any indication on when it will raise interest rates. However, any rise in interest rates is expected to be gradual and so should not be a big shock.

The table below shows, in simple terms, how a rise in Bank of England Base Rate will increase interest charge on an interest-only mortgage or loan on a yearly basis:

For repayment mortgages, monthly or yearly payment would be different depending upon the remaining term of the mortgage.

What does this mean for businesses?

Businesses are likely to benefit from increased inflation in the short-term as people are spending more money. Government will also continue to support businesses over the next few months as the furlough scheme has been extended to September. As mentioned, interest rates have never been lower, so this is the best opportunity to borrow money at a low rate. If inflation remains high and the interest rate does rise, then it will be more expensive to get a loan. If you are considering taking out a loan for your business, again it is important to listen to what the Bank of England says as it may give some suggestion as to when rates will increase.