Several economies including America and most parts of the Eurozone are going through an economic slowdown. Per data from the IMF, this is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic.

Interestingly, in the same report, IMF has shared economic growth projections for the world and India`s projected economic growth rate is higher than the projected growth for all other advanced economies as well as emerging and developing economies.

The Indian Economy has performed relatively better and we have not seen any signs of a slowdown or recession yet.

India’s domestic consumption and growing consumer market remain to be key drivers of its economic growth. This is supplemented by India’s demographic advantage of a large young population that is attractive both from a consumer and a talent pool perspective. As shared in our previous report, India is also emerging as a manufacturing hub for global supply chain.

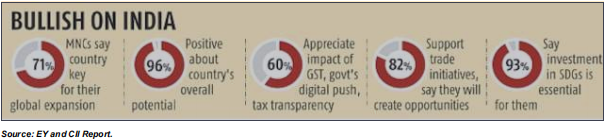

As per a recent survey conducted by EY & CII, 71% of MNCs consider India to be an attractive investment destination for their global expansion while 96% of the survey respondents were positive about India`s long term economic potential.

Positive data points have emerged from retail and real estate sales across the country. Retail businesses across India reported a 21% jump in sales in September 2022 compared to September 2019 or pre-pandemic levels, according to a business survey conducted by the Retailers Association of India (RAI). RAI’s survey findings reveal that sales across categories reported a steady increase with quick service restaurants in particular witnessing robust growth. A good indicator to watch out would be how this demand momentum continues beyond Diwali. Real estate sales across India’s top seven markets also recorded decent growth during the September quarter according to real estate services firm Anarock.

Retail Mega-Trends

Update on INR: The rupee has lost nearly 10% of its value compared to the dollar in the past year and has now breached the ₹83 mark.

A weak rupee translates to a higher import bill and therefore leads to higher prices (inflation). Similar to the rupee, all other currencies of the world have depreciated against the US dollar.

The rupee has in fact performed better than some of the other currencies like the British Pound and the Euro.

The US dollar is appreciating as the US central bank is rapidly increasing interest rates to fight inflation which is leading investors to pour money into the US which is thus increasing demand for the dollar. At the same time as the global economy is going through a difficult time, global investors feel more confident about the US economy and are thus investing more money there.

Source: IMF, World Economic Outlook, October 2022

If any member of the Jamat wants clarification on the above circular or wants to share his views, he can write to us on [email protected].