Credit Freeze

A credit freeze, also known as a security freeze, is the best way to help prevent new accounts from being opened in your name. It’s absolutely free to freeze and unfreeze your credit, and it won’t affect your credit score.

When you use a credit freeze, you’re in control of who can access your credit information and when. It’s always free, easy, and a great way to protect yourself from identity theft.

You can add a freeze at any time for no charge. It won’t affect your credit score. Think of it as an extra layer of security for your credit report.

You have the power to remove or temporarily lift a freeze for a set amount of time when you’re ready to apply for new credit.

Credit Freeze vs. Credit Lock

Trying to decide which is right for you? Credit freezes and credit locks both block access to your credit report, keeping new accounts from being opened in your name. But they are not the same thing and there are a few differences that you should understand.

When should I use Freeze?

If you want a free option to make sure no one can access your credit report.

How fast is it?

Adding or removing a credit freeze often happens in real-time, but to be on the safe side, allow up to one hour for it to go into effect.

Will I receive status alerts?

No, a credit freeze won’t send you alerts, but you can log in at any time to see your freeze status.

When should I use Lock?

When you want to make sure no one can access your credit report and are interested in additional features to improve credit health.

How fast is it?

Locking or unlocking your credit happens instantly.

Will I receive status alerts?

Yes, you’ll receive alerts if someone is trying to pull your credit report or if your credit report changes in a critical way.

Is it free?

It depends, usually, it is a paid subscription that offers locking of your TransUnion and Equifax reports, alerts, and additional features.

For more detail about credit freese click here

How to Save Money and Pay Off Debt

Everyone knows you should save for the future, but if you also have debt, it might seem tricky to figure out which should be your priority. For most people, the answer is both. Balancing savings and debt elimination does not have to be difficult, but it sometimes requires a bit of planning. Here are some pointers on how to save money and pay off debt at the same time.

In order to reduce your debt while saving money, you need to set a realistic goal for each. A good way to do this is to designate a percentage of your income to set aside as soon as you get paid.

Set Two Achievable Goals

Then decide how much of that amount to deposit into savings and how much to put toward your debt. Eliminating high-interest debts like credit cards first makes financial

sense, simply because the 18 to 20 percent interest many credit card companies charge can add up quickly. However, it is also important to have an emergency fund of at least three months of income, in case you experience a job loss or other emergency.

Don’t Underestimate the Cost of Your Debt

High-interest debt takes money from your checking account that you could otherwise put toward your future. Consider this: If you have $1,500 on your credit card and your interest is 18 percent, paying only the minimum of $37 per month means it would take over thirteen years to eliminate the debt completely, costing you $1,760 in interest. However, if you put just $10 more toward your monthly payment in addition to the minimum, you’ll have the debt eliminated in under four years and only pay $557.59 in interest.

Reduce Your Spending

Creating a budget and tracking your spending is a useful way to identify extra money that can go toward your goals. This may mean packing your lunch for work instead of eating out or postponing your vacation this year. If your goal was to create that emergency fund by saving 10 percent of your earnings, it would take you two and a half years to get three months’ income set aside. Nudge that up to 20 percent and you could reach the same goal in half the time — just 15 months.

Prioritize and look for the Best Return

Each person’s financial situation is different and life circumstances can change dramatically over time. For example, if your employer matches your 401(k) contributions, you’ll get a 100 percent return on every dollar you invest. So, you may want to maximize your contributions, even if it will take longer to pay off your debts.

Similarly, if you’ve paid off all of your high-interest loans, it may be time to start siphoning more money into your savings or investments. Whatever your financial situation is, it’s also important to look over your strategy every few months to ensure your plan is making the most of your money.

For more detail about how to save money and pay off debt click here

Is it Better to Pay Off the Entire Credit Card Balance?

Paying your credit card balance in full each month can help your credit scores. There is a common myth that carrying a balance on your credit card from month to month is good for your credit scores. That simply is not true.

It's Best to Pay Your Credit Card Balance in Full Each Month

Ideally, you should charge only what you can afford to pay off every month. Leaving a balance will not help your credit scores—it will just cost you money in the form of interest.

Carrying a high balance on your credit cards has a negative impact on scores because it increases your credit utilization ratio.

Your credit utilization ratio, or balance-to-limit ratio, shows how much of your available credit you are using and is the second most important factor in your credit scores. To determine your utilization ratio, divide your total credit card balances by your total available credit.

Always try to stay under 30% utilization overall and on individual accounts; credit scores decrease much more rapidly when you exceed that percentage. Even if your overall utilization rate is low, having a high utilization on just one of your cards can have an impact. For top credit scores, keep your utilization in the single digits.

For more detail about Is it better to pay off the entire credit card balance click here

What Helps Your Credit Score the Most?

The single most important factor in credit scoring is payment history—whether or not you make all your payments on time. Even one missed payment can have a significant impact on your credit scores.

If you are trying to establish a strong payment history, you can do so by making small purchases on your credit card and then paying the balance in full and on time each month. This practice keeps the card active and your balance well below your credit limit. It also demonstrates that you consistently manage debt well, which can help increase your credit scores.

In addition to keeping your balances low and making payments on time every month, here are other ways you can improve your credit:

Bring any past-due accounts current. If you have past-due accounts on your credit report, bringing them current is the first step to rebuilding your credit history. This includes paying off any collection accounts.

Apply for credit only when you need it. When you apply for credit, the lender typically checks your credit through what is known as an inquiry. Although credit report inquiries typically have a small impact on scores, it is best to apply for credit judiciously. Keep in mind that you can check your own credit report as often as you like without hurting your credit scores.

Why Did My Credit Score Drop?

Your credit scores are calculated using the information in your credit reports, so it is normal to see your score change as lenders provide updates to that information. A slight drop in your score may not be cause for worry, especially if you are consistently practicing good credit health habits. Sometimes, you may not notice changes on your credit report that lead to a score drop. Your credit score can drop for many reasons, including some of the common reasons below.

Missed Payment

Your payment history is one of the most important factors in your credit score. Missing even a single payment can have a significant impact on your score. That said, there is no exact answer to how much a particular missed payment will affect your score. This depends on your unique individual credit profile.

Payment history is built month-by-month as lenders report your account status to one or more of the three national credit reporting agencies. Credit card, car loan, mortgage and retail account (like store credit cards) payments will appear in your payment history.

If you missed a payment by accident, set up automatic payments if you can. This is an easy way to keep this important credit score factor in check. If you see a big credit score drop and aren’t sure if you missed a payment, review the payment history on each account in your credit report. You will be able to find potential missed payments there. If you see a missed payment listed but do not think it’s accurate, you can contact your lender for more information.

High balances

If you have made a big purchase and haven’t paid it off yet, or you keep high balances on your credit cards, your score could be affected too. Ideally, you want to keep your credit utilization rate lower than 30%. This means if you have a $10,000 credit limit, it is a good idea to try keeping a balance of less than $3,000 each month. Because there are different scoring models, 30% is not a magic number. It is more of a recommended goal as you work to decrease your balances. Paying off your balances on time and in full each month is key to maintaining good credit health.

Some people like to use a balance transfer credit card to help lower their credit utilization rate and buy some time to pay down credit card debt. This is not necessarily a bad strategy. But applying for a new card can drop your credit score temporarily because of the resulting hard inquiry. Inquiries tend to have less of an impact than missed payments and credit utilization.

Using a balance transfer card or another approach can help ease the debt burden in the short term, but you should always focus on developing good credit habits. If habits don’t change, it’s easy to continue to add more debt, turning short-term fixes into a long-term problems.

Derogatory marks

Missed payments are not the only derogatory marks that can hurt your credit score. When foreclosures, bankruptcies, and accounts in collections are reported, this negative information can also bring down your credit score. With some exceptions, most derogatory marks stay on your credit report for up to 7 years. Bankruptcy records stay on your report for up to 10 years. Negative information tends to have a less severe impact on your credit score as time goes on.

Time and consistent good habits are the keys to long-term credit health. One good habit is to monitor your credit consistently so you can manage and protect your information.

As you continue your path to healthy credit, your credit score sometimes may go down for one reason or another. Often, you may expect it, like when you apply for a new car loan or mortgage. Sometimes there are unexpected mistakes, like missing a payment. Either way, it is normal that dips happen. If you keep building your credit knowledge and develop good habits, you can achieve the credit score you want so you can access the opportunities you deserve.

For more detail about Why did my credit score drop click here

Why Is It Important to Have Good Credit?

A good credit score is important. Many companies check your credit, from mortgage lenders to insurance companies to landlords. If your score is low, you may not be able to borrow money or live where you'd like. Or you may pay more for loans.

The good news is, there are steps you can take to monitor your credit score for free and to increase it if necessary. Your credit score can change quickly if you embrace responsible borrowing behavior and remove inaccurate information. It's worth taking these steps due to the importance of good credit.

It's important to know where your credit score is at in order to know what steps to take to improve it.

For more detail about Why is it important to have good credit click here

Why is having a good credit score important?

A good credit score is important for five key reasons:

- Having good credit gives you a choice of borrowing options.

- A good credit score makes borrowing cheaper.

- Landlords check your credit score.

- Your credit score affects insurance rates.

- Employers check your credit score.

You may have fewer borrowing options with poor credit. For example, refinancing private student loans might not be possible since refinance lenders require good credit. Poor credit may also prevent you from getting the best rewards cards or a good rate on a personal loan.

A low credit score will not just leave you with fewer borrowing options. While loans for bad credit are sometimes available, lenders will typically charge a higher interest rate for it. For these reasons, one of your top financial goals should be to improve your credit scores.

Finally, insurance companies, employers, and landlords also check your credit. You may be denied the chance to live in your chosen apartment. Or an employer may not offer you a job if you have a problematic credit history. Your insurance rates will typically also be higher.

What is a good credit score?

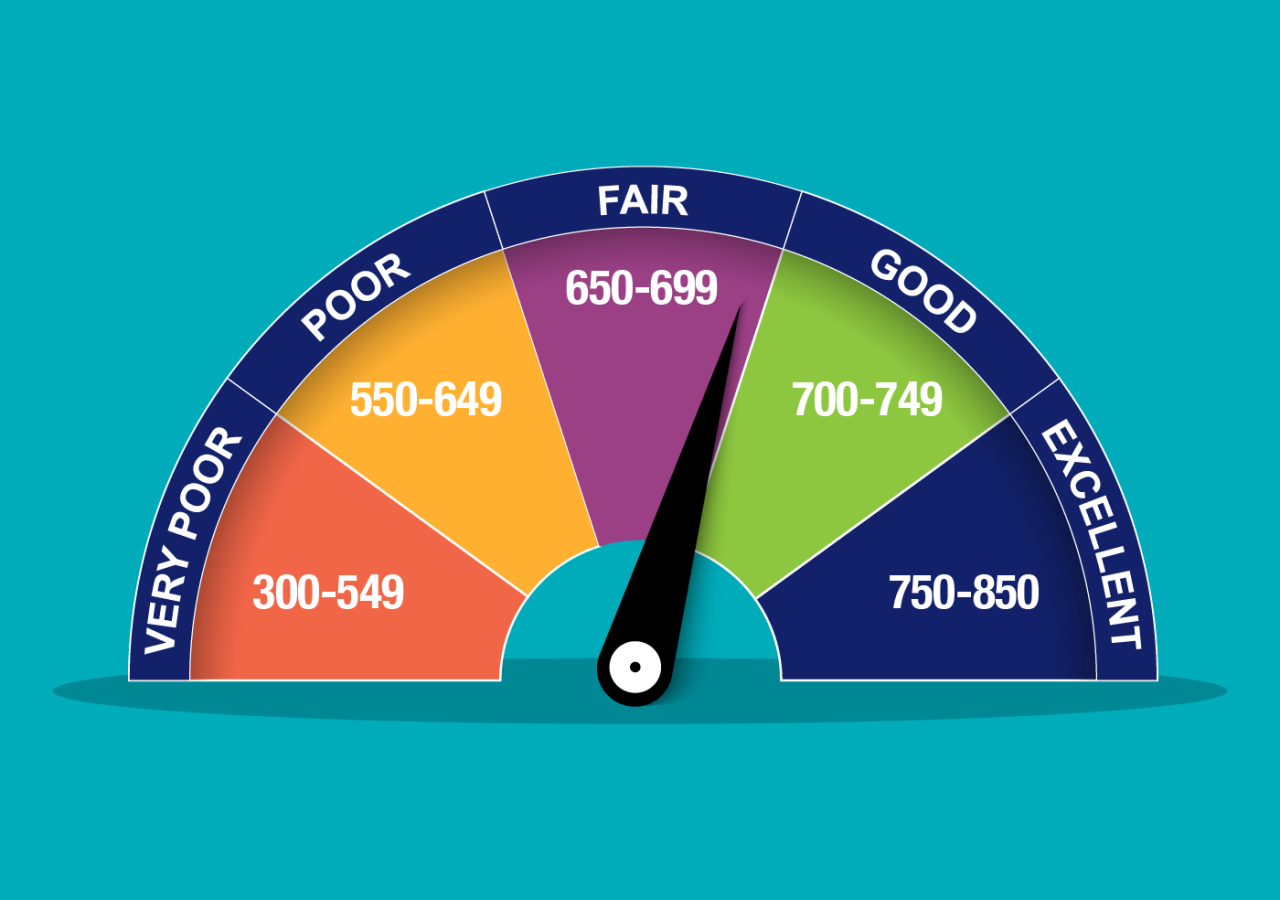

There are actually different types of credit scores, but FICO scores are the most common score used by many lenders. FICO scores range from 300 to 850, with higher scores representing better credit and lower scores showing bad credit.

A score of 300 to 579 would be considered very poor, while scores between 580 and 669 are fair. Good scores are between 670 and 739, while very good scores range from 740 to 799. Finally, scores above 800 are classified as excellent credit.

Is it important to watch my credit score consistently?

Keeping tabs on your credit is important.

By monitoring your credit, you can see how your financial decisions, such as paying down your personal loan, improving your payment history or lowering your credit utilization, are affecting your credit. You can also make sure no one has applied for unauthorized credit in your name and can confirm there are no mistakes on your credit report.

It is a good idea to check your score at least once every few months, if not more often.

How can I quickly raise my credit score?

If your credit score is not as high as you'd like it to be, you have options for improving your credit. In fact, making a few smart financial moves could help improve your credit scores quickly. The moves that rank highest when it comes to affecting your credit include:

- Repaying debt: The credit utilization ratio is one of the key determining factors in your score and a major factor to focus on when it comes to credit repair. It is determined based on the amount of available credit used. If you repay some of your debt, you will reduce your ratio because you'll be using less of your available credit -- and your score should go up.

- Becoming an authorized user: When someone adds you as an authorized user to a credit card with long, positive payment history, the credit card history shows up on your credit report and improves your own credit record.

- Using Experian Boost: Experian offers a tool called Experian Boost that allows you to connect your bank accounts to your credit record. This enables data on utility payments and payments to streaming services to be considered in determining your credit score. It can increase your score if you do not have a long history of positive credit payments.