The National Economic Planning Board has dedicated February as Retirement Savings Month, so we encourage readers to reflect upon a few key points about planning for one’s future.

2020 has brought into focus many aspects of our lives in terms of our health, profession, education, family, and emotional and spiritual wellbeing.. As we go through various stages of life, we constantly evaluate – our quality of life and how we may improve it. When thinking about retirement, some may say, “I have children who will take care of me when I am older;” Others may think “I am too young and have plenty of time to worry about retirement later.” Many may wonder, “How can I save for retirement when I earn only enough to pay bills and cover necessary expenses today?” This latter has become even more acute since 2020, as we all face the pandemic.

Despite our specific circumstances, each of us hopes that there will be a time in our life when we can retire and enjoy our senior years with comfort and dignity. In order to ensure a comfortable life during our golden years, it is important for everyone to plan and save enough money to cover our living expenses and support our desired lifestyle.

This month we will focus on some key areas:

Savings for retirement

Do you have retirement savings account for yourself? It is important to maximize your contribution allowed under federal rules and make a monthly contribution as part of your monthly budget. Do you know the retirement savings contribution limits for 2021? Is pre-tax (Traditional IRA) or after-tax (Roth IRA) better? Consulting with your CPA and financial advisor can help answer many of these questions.

Health Savings Account

As we age, the medical costs also increase and we must be prepared to cover these. How can we save for them so that they may be used later in our retirement? Health Savings Account (HSA) is one such vehicle and is only available with high deductible health plans. However, if you have pre-existing conditions this type of plan may NOT be the best option for you.

Long Term Care

Long Term Care is insurance coverage that provides funds for care later in our retirement. Generally, our families help take care of but what if they are unable to do so? The cost of individual care at a facility or even with a private caregiver at home is increasing every year and generally has to be paid for by ourselves. Let us start by understanding how it works and what options are best suited for you so that you can start making informed decisions.

Social Security

Social Security plays an important role in this country. An annual checkup of one’s account is important. Also, is the earnings information in the account correct? What is your full retirement age and what monthly benefits are you eligible for? The age at which one should apply for benefits depends on one’s health and other factors, in order to maximize the amount received. All this information will help you plan for your retirement.

Our goal is to ensure the Jamat is aware of the importance of saving and taking necessary steps to not only open but also to regularly fund their retirement savings account.

You can learn about more ways to secure your future by registering for the following webinars: Business owners can click here to register the retirement savings webinar on February 10th, 2021 at 8:00 p.m. CT. Non-business owners can click here to register for the retirement savings webinar on February, 24th, 2021 at 8:00 p.m. CT.

Individual Retirement Account (IRA)

What is an IRA?

An individual retirement account (IRA) offers tax benefits that can help you save money you will need for your retirement. An IRA comes in two versions:

- Traditional IRA – Invest after-tax money (maybe deductible when filing taxes); defer taxes on earnings until withdrawal, usually during retirement.

- Roth IRA – Invest after-tax money; withdrawal of earnings and contributions are tax-free if conditions are met.

Both choices offer significant tax advantages and Investment compounding potential, giving you the flexibility to make withdrawals during retirement as tax rates rise and fall.

Please see below for the contribution limits for the year 2020 and 2021 based on your status.

Health Savings Account (HSA)

What is an HSA?

Health Saving Account (HSA) is a special type of savings account that is used to help pay for eligible medical expenses. You are eligible for an HSA if you participate in your employer’s high-deductible health plan.

What are the benefits of having an HSA?

Health Savings Account (HSA) benefit is designed to help you:

- Pay for out-of-pocket health care costs

- Save for retirement

- Improve your financial wellness

- Ttriple tax benefit

What is the triple tax benefit of an HSA?

Most important to know is that NO other account offers the same triple tax benefit as an HSA. What’s a triple tax Benefit? It means that the money in your HSA is:

- Pre-Tax dollars taken directly from your paycheck, thereby reducing your taxable income.

- Grows tax free within the account

- It is NOT taxed when you use it to pay for qualified medical expenses (now or in retirement).

How will the money in an HSA grow?

The money in your account is yours and remains yours for as long as you have the account; unlike your Flexible Spending Account (FSA), which is “Use-it-or-lose-it.” The money in your HSA rolls over every year, including what you have NOT used. In addition, HSA is portable, so that you can keep it even if you leave your current employer.

What are the contribution limits of an HSA?

*Both spouse are in age range

Note: Those who have medical conditions may not want an HSA account as the out of pockets expenses may be higher!

Financial wellness should mean financial flexibility for your short and long-term finances to adapt to your life. Paying for health care costs and planning for retirement are a big part of achieving flexibility in your quality of life.

Long Term Care (LTC)

Why is it important to save for Long Term Care (LTC)?

- One of the most important aspects of retirement planning is preparing for the possibility of needing Long Term Care or extended care. Someone with a long physical illness, a disability, or a cognitive impairment (such as Alzheimer’s disease) often needs Long Term Care.

- Long Term Care is typically defined as a variety of services and support to help people with everyday tasks, also called Activities of Daily Living (ADLs)1 over an extended period of time.

What are the costs of Long Term Care (LTC)?

- National Average - Nursing Home Costs in 20162

○ $225 a day or $6,844 per month ($82,128 per year) for a semi-private room

○ $253 a day or $7,698 per month ($92,376 per year) for a private room - National Average - Assisted Living Facilities Costs in 20162

○ $119 a day or $ 3,628 per month ($43,536 per year) for care in and assisted living facility (for one bedroom unit) - National Average Home health care costs2

○ $20.50 an hour for a health aide

Who pays for Long Term Care (LTC)?

- Individuals or families

- Medicare (if you qualify) – Medicare pays the cost of skilled nursing care in an approved nursing home or in your home, but only in specific situations. Medicare may cover up to the first 100 days of skilled nursing home care in each benefit period when you meet conditions, after 20 days you must pay a coinsurance fee.

- Medicare Supplemental Insurance (Medigap) – A private insurance that helps pay for some of the gaps in Medicare coverage.

- Medicaid – A government-funded program that pays for nursing home care only for individuals who are low income and have spent most of their assets. To get Medicaid you must meet federal and state guidelines for income and assets.

- Long Term Care Insurance – This type of insurance will pay or reimburse you for some or all of your long-term care costs.

Long Term Care Insurance Tax Information

- Long Term Care Insurance has a unique status in the tax codes. Not only are benefits usually received 100% tax-free, but policyholders may be able to deduct some or all of their premiums.

References:

- NAIC – Long Term Care

- Long Term Care website click here

- IRS code 213(d)(10)

Social Security (SS)

What is Social Security:

- Social Security (SS) is a federal benefits program. It can provide monthly benefits when you retire, if you become severely disabled, and support your family when you die.

- Your contributions to your Social Security helps you and your family qualify for those benefits. The benefit amounts are based on the earnings reported to the Social Security Administration. Therefore, it is important that you make sure your earnings record is correct.

- Social Security and Medicare Tax Rates for an employee is 7.65%, for an employer is 7.65%, and for someone who is self-employed is 15.30%.

Consider the following steps:

Contact the Social Security Administration

- Call the SS number at 1-800-772-1213

- Access online at www.socialsecurity.gov and use the SSA office locator to view your statements and review your earnings for accuracy.

Review your annual earnings statement

- Your monthly Social Security benefit is calculated based on your wages during your 35 highest-paid years in the workforce.

- It is important that the Social Security Administration has accurate wage information for you on file.

Check your credit report

- A fraudulent credit account in your name can impact your Social Security benefits, especially if someone else has access to your social security number.

- You are entitled to a free copy of your credit report each year.

Check if you qualify for Social Security benefits

- Income needed in 2020 to earn one credit - $1,410

- Maximum of four credits per year in 2020 - $5,640

- You need 40 credits to qualify for benefits or 10 years of working

- If you have less than 10 year – you are NOT qualified for benefits

- The longer you work, the more credit contributes to increase your benefits.

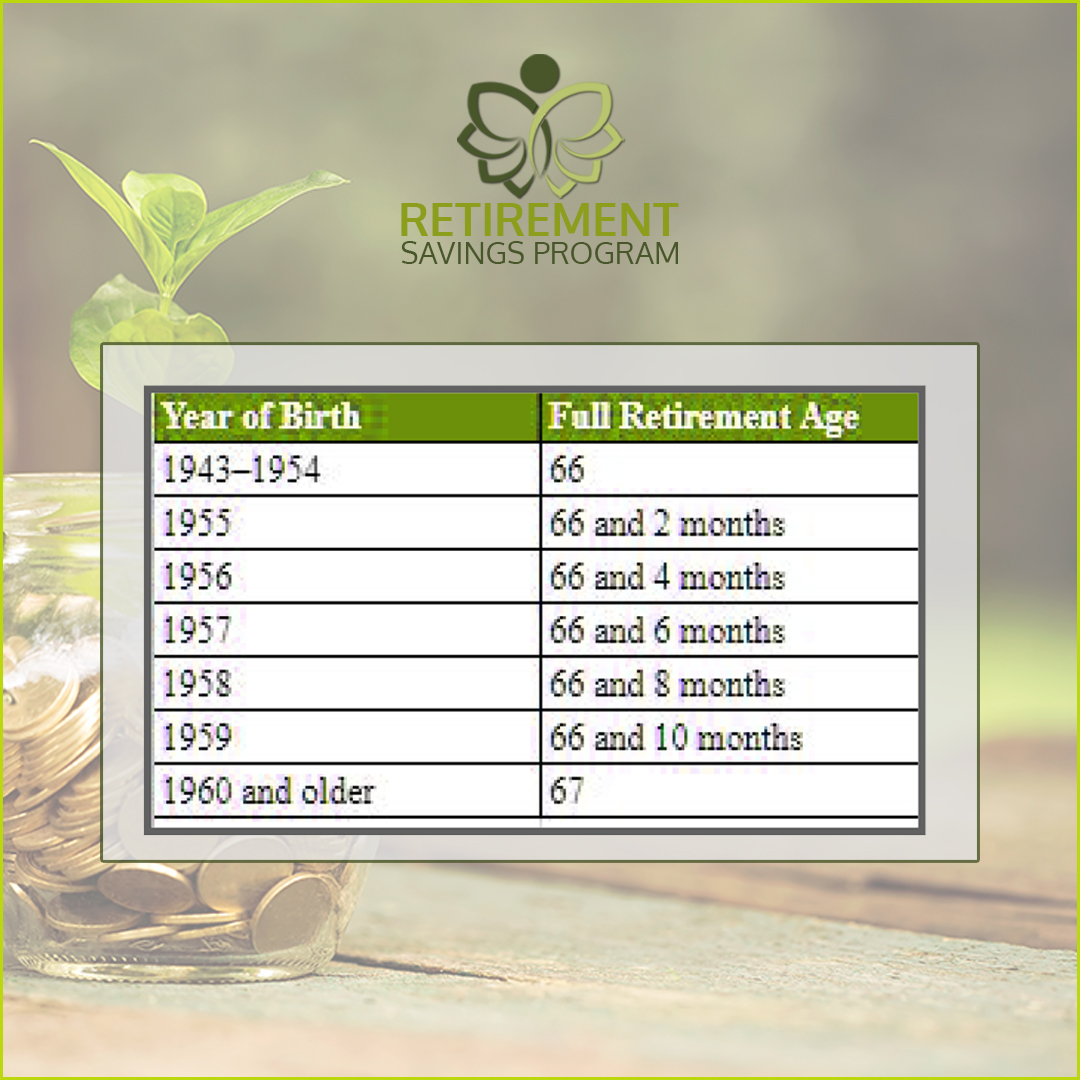

Check when is your full retirement age to claim Social Security benefits

- Full retirement age is the age at which you are entitled to receive full Social Security retirement benefits. Your full retirement age is based on the year you were born. The chart below shows your retirement age based on your year of birth.

The average age of longevity in the USA for a man is 84 and a woman is 86.5 years. Consider longevity as part of your retirement planning. You can start your Social Security benefits as early as 62, BUT you get a reduced benefit. The longer you wait the more benefits you will get - this can add up to be substantial.