Financial literacy refers to your understanding and effective use of various financial skills, from budgeting and saving to debt management and retirement planning. It equips you with the knowledge to make informed decisions, leading to enhanced financial stability, reduced stress, and an improved quality of life.

Financial literacy empowers you to take control of your finances and navigate the challenges and opportunities that arise. It is a crucial element in achieving financial health.

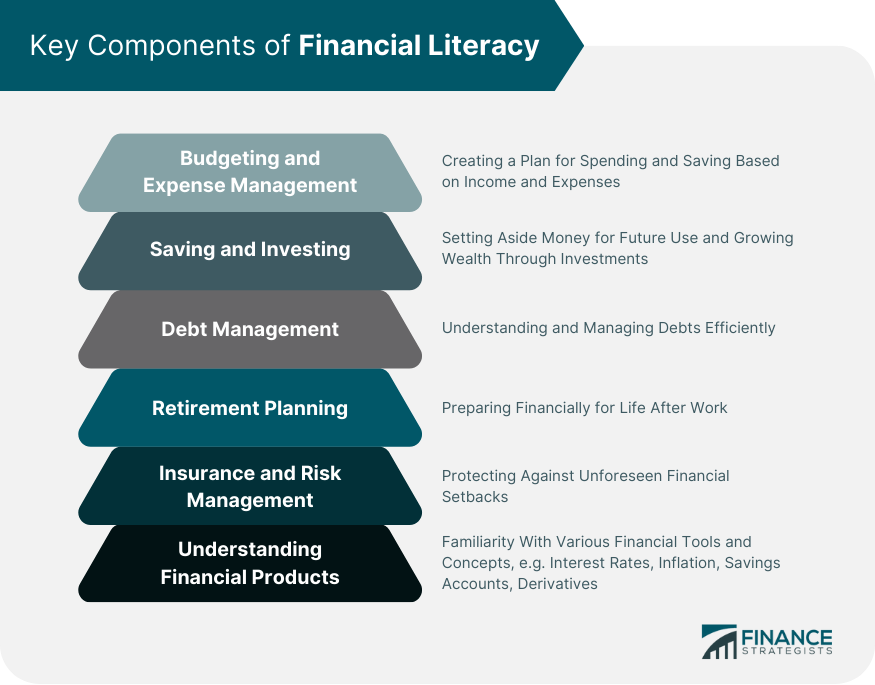

Key Components of Financial Literacy

Budgeting and Expense Management

Effective budgeting requires a clear understanding of your financial inflows and outflows, setting realistic goals, and monitoring spending habits. Expense management involves making intentional decisions to cut unnecessary costs and prioritise essential ones. By mastering budgeting and expense management, you can live within your means, avoid accumulating debt, and save for future goals.

Saving and Investing

Saving is setting aside a portion of your income for future use, while investing involves putting that saved money into assets or ventures that have the potential to yield returns.

Being financially literate also means recognising the impact of your credit score on interest rates, familiarising yourself with debt terms, and creating a strategy to pay off debts efficiently. It includes differentiating between good debt (such as student loans, which can be seen as an investment in your future) and bad debt (such as credit card bills for luxury items like the latest iPhone).

Retirement Planning

Financial literacy encompasses understanding pension plans and other retirement savings options, as well as Social Security and how delaying benefits can increase monthly payouts. A comprehensive retirement plan considers your expected lifespan, desired retirement lifestyle, and potential healthcare costs.

Insurance and Risk Management

Various products, such as health, life, auto, and property insurance, offer protection against different risks. Ensure you have adequate coverage based on your specific circumstances. Other risk management strategies include creating an emergency fund and building your savings.

Understanding Financial Products and Concepts

Strengthen your knowledge of various financial products, from simple savings accounts to complex derivatives. You should also be familiar with basic concepts like compound interest, inflation, and taxation. This knowledge ensures you can navigate the financial landscape and make informed decisions aligned with your goals and risk tolerance.

Strategies For Improving Your Financial Literacy

Self-Study and Online Resources

Numerous online platforms, websites, and apps offer courses, articles, tutorials, and tools related to financial education. From understanding the basics of budgeting to exploring advanced investment strategies, you can learn at your own pace based on your comfort and needs. Podcasts, webinars, and video tutorials cater to different learning styles by offering diverse formats. However, it is crucial to ensure that the sources of information are credible and up to date.

Accessing Formal Education and Awareness Programs

The foundation of financial literacy often begins with structured education. Schools, colleges, and universities provide basic courses in money management, economics, and personal finance.

Seeking Professional Advice

Financial advisors, planners, and counsellors bring expertise and experience to the table. They can offer tailored advice based on your financial situation, goals, and risk tolerance. Whether you are planning for retirement, investing in the stock market, or buying a home, professional advisors can guide you through complex decisions. As financial landscapes evolve, professionals can also provide updated insights to ensure you stay informed.

Networking and Learning from Peers

There is immense value in shared experiences. Networking with peers, either informally or through structured groups, can offer new perspectives on financial management. Hearing about others’ financial successes and challenges can provide practical insights and lessons. Moreover, peer discussions can introduce you to new financial tools, products, or strategies you might not have discovered otherwise. In a rapidly evolving financial world, staying connected with a network can keep you updated and informed.

Conclusion

Financial literacy is an essential skill in today’s world. Beyond ensuring financial health, it empowers individuals, reduces stress, and fosters a sense of security. It encompasses budgeting, saving, investing, retirement planning, debt and risk management, and understanding financial products and concepts. You can improve your financial literacy through self-study, formal education, seeking professional advice, and networking with peers.

Adapted from: Why Financial Literacy Is Important And How You Can Improve Yours (forbes.com)